Corn is extensively used to feed livestock, but the surge in spot prices has forced US farmers to search elsewhere for low-cost substitutes, reported Reuters.

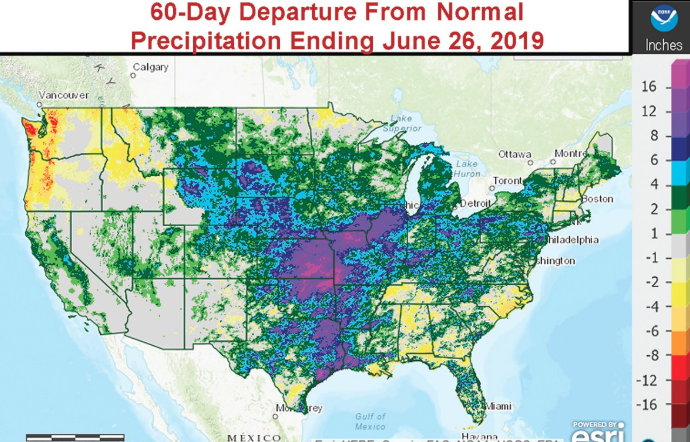

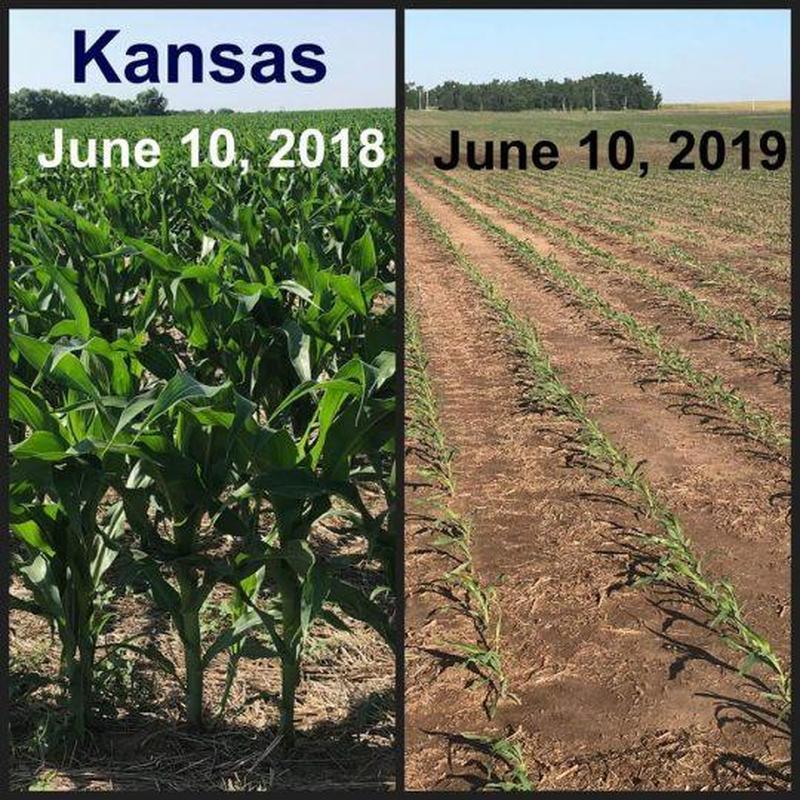

The persistent wet weather that swamped the Midwest this spring is now reducing corn yields.

More recently, dry, hot weather continues over large swaths of the Midwest, is also wreaking havoc on corn yields. Volatile weather as a whole, in 2019, could lead to one of the lowest corn harvests in years.

The US Department of Agriculture (USDA) last month projected 2019 corn production at 13.88 billion bushels, an 8% drop YoY.

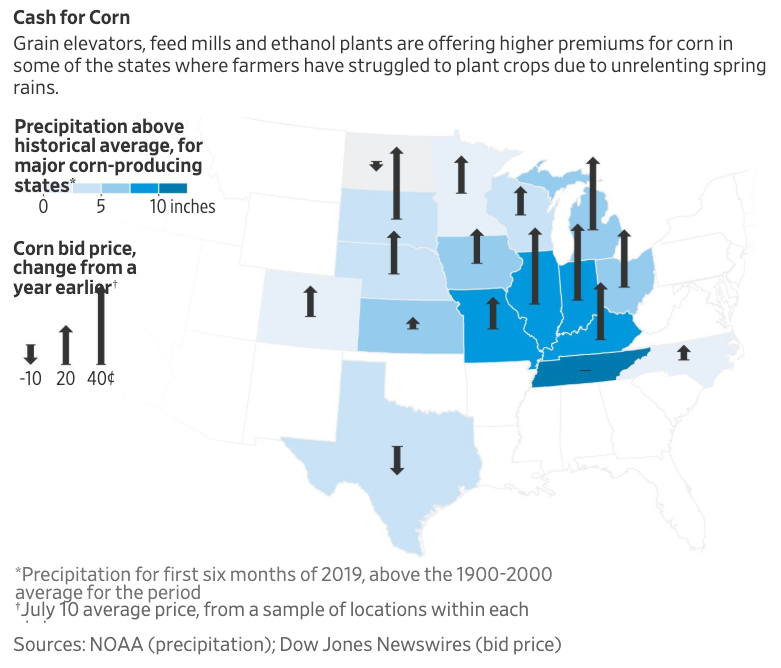

Agricultural organizations, equipment dealers and factories that convert corn into ethanol have already felt the pressure from farmers because of millions of acres went unplanted due to wet weather across the Central and Midwest, including corn and soybean belts.

Accurate picture of how the spring of 2019 has been so far. (Yes, that is a turtle swimming in the corn) pic.twitter.com/LUAoDbnY03

— Peter Bergkamp (@pbergkamp791) June 23, 2019

Reuters spoke with meat producers who are now rushing to find substitutes to avoid margin compression from skyrocketing corn prices; they’re attempting to stretch out supplies of corn held in storage.

Experts have warned spot prices of corn could jump once harvesting begins this fall because declining yields will be realized.

Higher prices for corn could translate into higher meat prices, which are already soaring after China’s African swine fever crisis has led to the deaths of hundreds of millions of pigs.

USDA supermarket data showed retail pork prices had soared 9% YoY versus this time last year, while beef prices are up 2%. Rising food costs are occurring at a time when the overall economy is rapidly slowing.

The wettest 12 months on record in the Midwest has put thousands of farmers behind the planting season. The number one risk is that corn might not reach full maturity and early frost could devastate crop yields even further.

The USDA shows about 57% of the US corn crop is in good condition, plunging from 75% at this time last year.

High corn prices have led to margin compression for major meat producers like Tyson Foods, who will ultimately pass on the costs to consumers.

Cargill said last month its quarterly net profit crashed 67% from last year, partly due to disruptions in the growing season in spring.

“End users are in a panic,” said Tanner Ehmke, industry research manager for agricultural lender CoBank.

Crop traders, ethanol plants, and livestock producers “want corn now because of the unknowns on this crop.”

Jason Britt, president of Central States Commodities, said rains and floods are making farmers “tighter-fisted. Britt said his family’s northern Missouri farm has 100,000 bushels of corn in storage; traders are already offering him a premium for the crop.

“The circumstances have changed this year, so for us [we need] a larger security blanket,” Mr. Britt said.

Ohio farmer Jim Heimerl sells 700,000 pigs per year, has swapped out corn with expired pet food, which he acquired in bulk through a broker. Heimerl is feeding the pigs other substitutes, including wheat middlings.

“We’re already starting to ration our corn out,” he said.

Corn spot prices chart

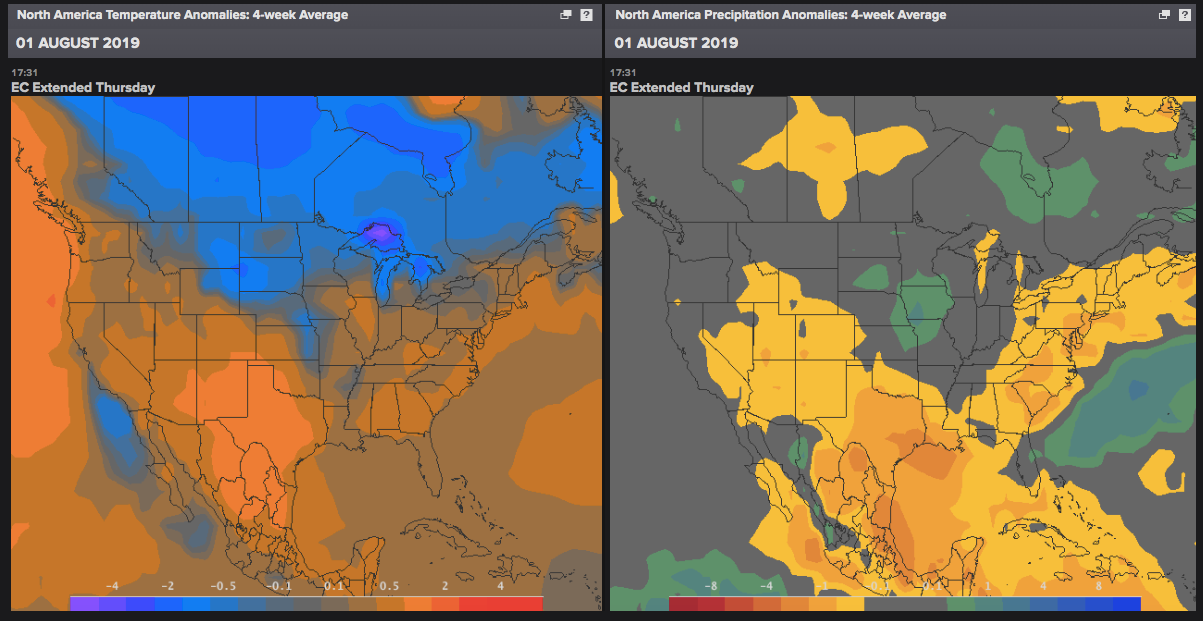

For the first half of August, weather models show cooling weather prevailing through the Central and Midwest. Reuters noted this could further delay crop development at a time when corn needs it the most:

“1-15 Day Forecast: Model guidance (both GFS & EC) remains consistent showing cool weather prevailing through the first half of August across the Central and Midwest U.S., including the Corn and Soybean belts. As mentioned in previous reports this could further delay crop development and be the potential catalyst of future issues should the season be pushed back even further as a result. Moreover, both models agree on expected rainfall across most areas through 10 days. A widespread pocket of dryness is expected across Wisconsin, Iowa, northern Missouri, Illinois, Indiana, and Ohio. Furthermore, the GFS extends this period of dry weather through the 11-15 day time frame. As mentioned in recent updates, continued dryness across some areas in Illinois, Indiana, and Ohio could become more of a concern for corn and soybeans in key developmental stages if prolonged.

Extended Outlook: The EC extended run from 01 August paints a different picture than the former run from 29 July. This most recent backs off from extensive coolness across the central/Midwest U.S. which was shown in the 29 July scenario, and rather limits lasting coolness to Canada and the far northern U.S. Plains. The rest of the U.S., including the Midwest, is now expected to be warmer than normal when averaged through the next 4 weeks, though this is just one model run. This most recent run also depicts wetter conditions across the Midwest U.S., opposed to the run from 29 July which shows dry conditions across much of the region. Overall, if materialized later in the month this would be a more favorable scenario with warmer and wetter conditions possibly returning.”

Perhaps a perfect storm of factors mentioned above could result in the second leg up in corn spot prices in the months to come, especially around harvest time in fall.

via zerohedge

COMMENTS